Planning a Viking River Cruise is exciting. Choosing the best travel insurance is crucial.

A Viking River Cruise promises adventure, luxury, and scenic views. But unexpected issues can arise. Travel insurance ensures peace of mind, covering medical emergencies, trip cancellations, and lost baggage. With many options available, finding the right insurance can be overwhelming.

This guide helps you choose the best travel insurance for your Viking River Cruise. We’ll explore key features, benefits, and what to look for in a policy. Whether you’re a seasoned traveler or a first-timer, securing the right travel insurance ensures a worry-free voyage. Ready to embark on your dream cruise? Let’s dive in!

Contents

Why Travel Insurance Is Essential

Travel insurance gives peace of mind. You can relax on your trip. No worries about unexpected problems. If a cruise gets delayed, you’re covered. If you lose luggage, insurance helps. It takes away stress. You can enjoy your cruise more. Feel safe on your journey.

Travel insurance protects your wallet. It covers medical costs on a cruise. If you get sick, insurance pays the bills. It protects you from big losses. If you cancel a trip, you don’t lose all your money. Travel insurance keeps your savings safe. You can travel without fear.

Types Of Travel Insurance

Trip cancellation insurance is very important. It covers unexpected events. Sometimes, you may need to cancel. Maybe because of sickness or a family problem. This insurance helps you get back your money. Refunds can include flights and hotel costs. It’s a smart choice for any traveler.

Medical coverage is also crucial. It helps if you get sick on your trip. Doctors and hospitals can be expensive. This insurance pays for your care. Even a small injury can cost a lot. Without it, you might pay high bills. Peace of mind is worth it. Better safe than sorry.

Key Features To Look For

Comprehensive coverage for medical emergencies is crucial. Look for policies with trip cancellation benefits. Ensure your insurance includes baggage loss protection.

Coverage Limits

Choose a policy with high coverage limits. This protects you from large expenses. Medical emergencies can be costly. Your policy should cover them fully. Check the limits for trip cancellations too. Ensure it covers the total trip cost.

Emergency Services

Emergency services are crucial. Look for policies offering 24/7 emergency assistance. This includes medical help and travel support. Some policies offer emergency evacuation. This can be lifesaving in serious situations.

Credit: pavlus.com

Top Insurance Providers

Allianz Global Assistance is a trusted name in travel insurance. They offer comprehensive coverage for Viking River Cruise trips. Their plans include trip cancellation, medical emergencies, and lost luggage. Allianz is known for its excellent customer service and easy claim process. Coverage also includes 24/7 assistance during your trip. This can help in case of emergencies or travel changes.

Travel Guard offers affordable and flexible plans. They cover trip cancellations, medical emergencies, and baggage loss. Travel Guard is praised for quick responses and helpful customer service. Their plans also provide emergency medical transportation and concierge services. Travel Guard can give you peace of mind during your Viking River Cruise adventure.

Comparing Policies

Choosing the best travel insurance for a Viking River Cruise ensures peace of mind during your journey. Look for coverage that includes medical expenses, trip cancellation, and lost luggage. Comparing policies helps find the best protection for your adventure.

Price Comparison

Choosing the right travel insurance is important. Price is a key factor. Some policies cost more but offer better coverage. Compare different plans. Look at what each plan offers. Check if the price fits your budget. A good plan should be affordable and offer good protection.

Coverage Comparison

Coverage is another vital factor. Some plans cover more than others. Medical coverage is crucial. Make sure your plan covers medical emergencies. Trip cancellation is also important. Find a plan that covers cancellations and delays. Lost luggage is another aspect to consider. Ensure your plan covers lost or stolen items. Compare all these factors. Choose the plan that best fits your needs.

Reading The Fine Print

Insurance plans often have exclusions. These are things not covered. Common exclusions include pre-existing conditions. Also, risky activities like scuba diving. Read these carefully. You don’t want surprises later. Understand what is not covered. This helps avoid disappointment. Always ask questions if unsure. Get clear answers.

Knowing the claim process is vital. Simple steps make life easier. First, report the incident quickly. Then, gather all necessary documents. These might include receipts and reports. Submit these to the insurance company. Follow their guidelines strictly. This ensures a smooth process. Keep copies of everything. This helps if there are issues later. Always check the timeline for claims. Some have strict deadlines. This is important to remember.

Tips For Choosing The Right Policy

Think about what you need. Consider health coverage. Do you need trip cancellation? Lost luggage coverage? Different plans offer different things. Choose one that fits you best. Don’t pay for things you don’t need.

Brokers know a lot about insurance. They help find the best policy. They answer questions. They explain details. Brokers compare different plans. They save you time and effort. They can get you a good deal.

Credit: www.aardy.com

Real-life Scenarios

Missing a flight can ruin your trip. Travel insurance can help. It can cover extra costs for new flights. This means less stress. You can continue your journey smoothly. Insurance can also cover hotel stays. So, you won’t be stuck in the airport. Peace of mind is priceless.

Getting sick on a cruise is scary. Medical help may be far away. Travel insurance can pay for emergency care. This includes doctor visits and hospital stays. It can even cover getting you back home. You won’t worry about high medical bills. Enjoy your trip with confidence.

Credit: www.vikingrivercruises.com

Frequently Asked Questions

Is Travel Insurance Worth It For A River Cruise?

Yes, travel insurance is worth it for a river cruise. It covers unexpected events like cancellations, medical emergencies, and lost belongings. Peace of mind during your journey is invaluable. Always compare policies to find the best coverage for your needs.

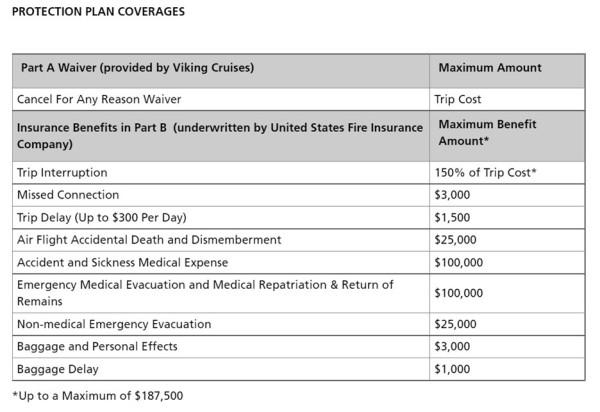

What Travel Insurance Company Do Viking Cruises Use?

Viking Cruises partners with TripMate for travel insurance services. TripMate offers various coverage options for Viking guests. For detailed information, check Viking’s website or contact their customer service. Always review policy details before purchasing to ensure it meets your travel needs.

Is Viking Cruise Insurance Worth It?

Viking cruise insurance can be worth it for peace of mind. It covers trip cancellations, medical emergencies, and lost luggage. Evaluate your needs and compare policies.

What Insurance Do I Need For A River Cruise?

You need travel insurance, including medical coverage, trip cancellation, and baggage protection for a river cruise.

Conclusion

Choosing the right travel insurance is crucial for your Viking River Cruise. It ensures peace of mind throughout your journey. Coverage for medical emergencies and trip cancellations is essential. Compare options and read reviews before buying. A good policy protects you from unexpected events.

Consider your needs and preferences carefully. This way, you enjoy your cruise without worry. Smart planning leads to a stress-free adventure. Safe travels!